Home insurance providers in New Brunswick offer coverage across the city, ensuring peace of mind for residents in all corners of this diverse locale. Regardless of your specific neighborhood, you can typically find a home insurance policy that matches your unique needs.

The following are the primary zip codes that we can insure:

Homeowners residing in New Brunswick have an array of insurance options. Understanding that all critical areas across different zip codes are covered under home insurance provides homeowners the assurance that regardless of where they choose to live in the city, they can find an insurance policy that provides suitable protection against potential risks.

New Brunswick, a key city in New Jersey, has a unique demographic layout that markedly influences the home insurance landscape here. To understand this influence, let's delve deeper into the city's essential demographic details:

Understanding these demographics illuminates how they inherently impact home insurance needs. For instance, a youthful population might have different insurance requirements compared to a more mature population, whereas an affordable insurance rate might encourage more homeowners to get adequate coverage.

Hence, homeowners must comprehend these dynamics to equip themselves better when negotiating for the most appropriate insurance policy.

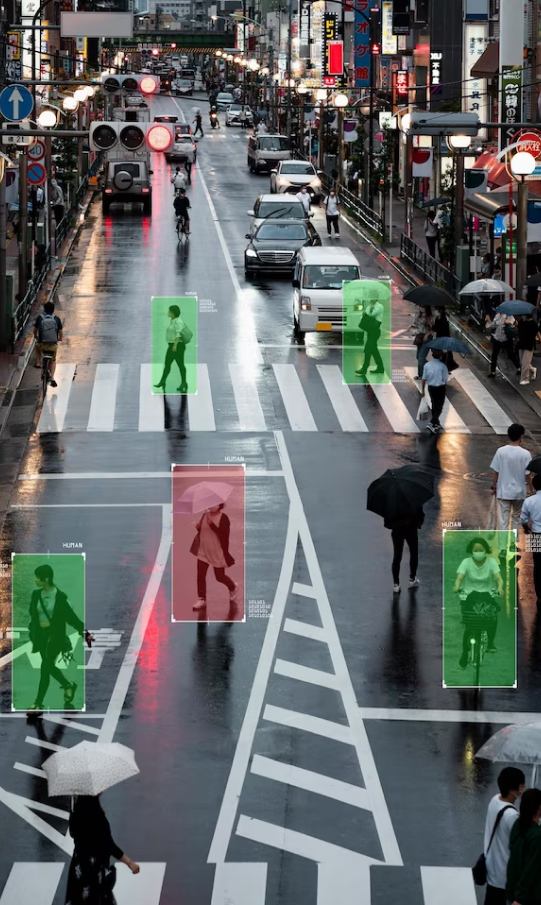

New Brunswick is a city of diverse neighborhoods, each carrying its unique atmosphere, character, and array of home insurance considerations. These neighborhoods influence the home insurance rates and coverage due to various factors inherent in each district.

Each neighborhood’s unique variables can substantially influence premium costs. These distinct yet interconnected factors — crime rates, housing types, and geographical location- elucidate the importance of location in determining home insurance policies and premiums.

Hence, an understanding of these variables can prepare homeowners when negotiating for tailored coverage that meets their specific neighborhood requirements.

Having robust emergency services positively impacts the area's risk assessment for home insurance providers.

Homeowners can be vigilant of their responsibility to the New Brunswick community by remaining informed of their local emergency services.

Knowing how to access and connect with these emergency services is vital for residents, as swift assistance during unforeseen incidents can vastly reduce potential damages and alleviate any added burden on homeowner insurance costs.

In conclusion, understanding the nuances associated with your city's demographics, zones, and emergency services is paramount for securing a fitting home insurance policy. Thorough research and consultation with insurance experts are vital actions for homeowners in New Brunswick to secure a personalized, comprehensive home insurance package.